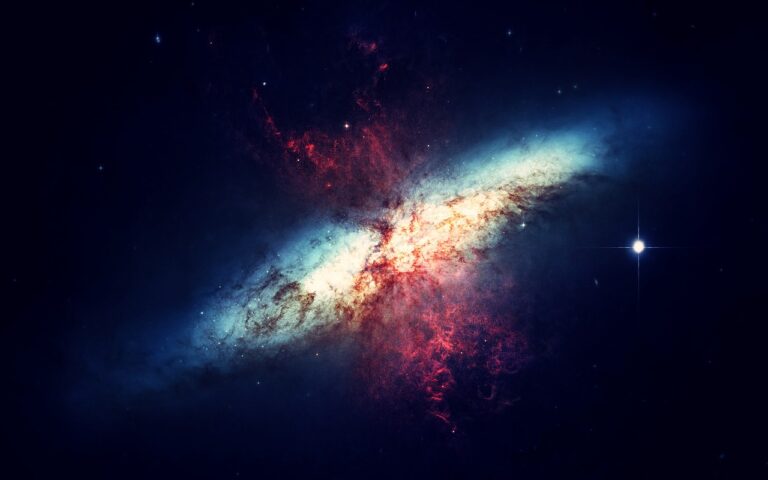

Curious about delving into the world of cryptocurrency mining beyond Bitcoin? As an avid enthusiast in the blockchain space, I’ve explored the exciting realm of mining altcoins and the promising opportunities they present. While Bitcoin remains the flagship cryptocurrency, numerous alternative coins offer unique advantages and potential for profitable mining ventures.

In this article, I’ll share insights into the diverse landscape of altcoin mining, highlighting lesser-known digital currencies that could be the next big thing. From understanding the differences in mining algorithms to identifying promising altcoin projects, I’ll guide you through the essentials of expanding your mining portfolio beyond Bitcoin. Join me on this exploration of the evolving crypto mining scene and discover the untapped potential of altcoins waiting to be unearthed.

Understanding Altcoins and Their Significance

What Are Altcoins?

Altcoins refer to any cryptocurrency other than Bitcoin. These alternative digital currencies introduce innovations and variations compared to Bitcoin, such as different mining algorithms, transaction speeds, or privacy features. Examples include Ethereum, Litecoin, and Ripple.

Why Consider Mining Altcoins?

Mining altcoins can offer diverse opportunities beyond Bitcoin. Some altcoins may have lower mining difficulty levels, potentially leading to increased mining rewards. Additionally, early adoption of promising altcoin projects can result in significant profits as their value appreciates over time. It’s essential to research and identify altcoins with strong fundamentals and growth potential for successful mining ventures.

How Altcoin Mining Differs From Bitcoin Mining

Altcoin mining differs from Bitcoin mining in several key ways. Understanding these distinctions is vital for crypto miners looking to explore opportunities beyond Bitcoin.

- Key Technological Differences|

When comparing altcoin mining to Bitcoin mining, one crucial difference lies in the mining algorithms used. While Bitcoin primarily relies on the Proof of Work (PoW) algorithm, altcoins may utilize different algorithms such as Proof of Stake (PoS), Proof of Capacity (PoC), or other variations. These varying algorithms impact energy consumption, mining hardware requirements, and overall mining process efficiency. - Profitability Comparison

Analyzing the profitability of altcoin mining in contrast to Bitcoin mining involves evaluating factors like mining difficulty, block rewards, and market demand for specific altcoins. Altcoins often present lower mining difficulty levels than Bitcoin, potentially offering higher rewards for successful mining endeavors. Additionally, the value appreciation of certain altcoins can lead to significant profits for early adopters, making strategic altcoin mining a lucrative opportunity in the dynamic cryptocurrency landscape.

Popular Altcoins to Mine in 2023

Cryptocurrency mining enthusiasts are always on the lookout for the next big opportunity beyond Bitcoin. In 2023, certain altcoins stand out as promising options for miners to explore further. Let’s delve into the specifics of two popular altcoins that could present lucrative mining prospects.

Ethereum and Its Mining Dynamics

As an avid miner, I always keep an eye on Ethereum due to its widespread popularity and strong market presence. Ethereum uses the Ethash algorithm, making it an attractive choice for GPU miners. With Ethereum’s transition to a proof-of-stake (PoS) consensus mechanism in the near future, mining dynamics are set to undergo a significant transformation. While PoW mining will eventually phase out, transitioning to PoS could offer new opportunities for miners to stake their coins and earn rewards through validation.

Litecoin, a Favorite for Beginner Miners

In my experience, Litecoin has been a go-to option for novice miners looking to enter the cryptocurrency mining space. Being one of the early Bitcoin spin-offs, Litecoin offers a simpler mining process compared to Bitcoin. Its Scrypt algorithm is ASIC-resistant, making it feasible for GPU and CPU miners to participate effectively. With faster block generation times and lower transaction fees than Bitcoin, Litecoin remains a popular choice among miners seeking a stable and potentially profitable alternative in the crypto mining landscape.

Setting Up for Altcoin Mining

When preparing for altcoin mining, selecting the appropriate hardware and software ensures efficiency and profitability in your mining endeavors.

Choosing the Right Hardware

To maximize your mining output, it’s essential to select hardware tailored to the specific altcoin you plan to mine. For example, GPUs are popular for mining Ethereum, while ASICs are preferred for mining Litecoin. Each altcoin has unique hardware requirements based on its mining algorithm, so researching and investing in the right equipment is crucial for successful mining operations.

Software Requirements for Efficient Mining

Equally important to hardware selection is using efficient mining software that is compatible with the chosen altcoin. Software plays a vital role in optimizing mining performance and ensuring smooth operation. Popular mining software options like CGMiner and Claymore are widely used for their reliability and performance benefits. Additionally, staying updated with the latest software releases and advancements in mining technology can further enhance your mining efficiency and profitability.

Potential Risks and Rewards of Altcoin Mining

When considering altcoin mining, it’s essential to evaluate the potential risks and rewards associated with this venture. Altcoin prices can be highly volatile, which may lead to significant fluctuations in mining profitability.

Evaluating the Volatility of Altcoins

I monitor the volatility of altcoins regularly to assess the risk involved in mining operations. The unpredictable nature of altcoin prices can impact mining profitability, making it crucial to stay informed about market trends and price movements.

Long-Term Potential of Mining Altcoins

I acknowledge the long-term potential of mining altcoins, as it offers the opportunity to accumulate digital assets that may increase in value over time. By strategically diversifying altcoin mining activities and holding onto mined coins, I aim to leverage potential future price appreciation for sustainable rewards.