Navigating the volatile waters of the crypto market often feels like deciphering a complex puzzle. As an avid observer of digital assets, I’ve witnessed firsthand how geopolitical events can send shockwaves through the world of cryptocurrency. From regulatory announcements to global tensions, every geopolitical development has the potential to sway market sentiments and alter the trajectory of digital currencies.

In this article, I’ll delve into the intriguing relationship between geopolitical events and the crypto market. By analyzing past trends and identifying key patterns, I’ll shed light on how political upheavals can trigger rapid fluctuations in cryptocurrency prices. Join me on this insightful journey as we explore the intricate dance between global politics and the ever-evolving landscape of digital assets.

Understanding Crypto Market Dynamics

As an expert in cryptocurrency trends, I delve into the intricate dynamics of the crypto market to decipher how geopolitical events impact digital assets. Understanding the basics of cryptocurrency markets and exploring the correlation between geopolitical events and market shifts are key to navigating the volatile nature of the crypto space.

The Basics of Cryptocurrency Markets

In the realm of cryptocurrency markets, the law of supply and demand reigns supreme. The value of digital currencies is largely determined by market participants’ perceptions, sentiments, and trading activities. With a finite supply for most cryptocurrencies, changes in demand can significantly impact their prices. This fundamental principle underscores the decentralized and volatile nature of crypto markets.

How Geopolitical Events Influence Markets

Geopolitical events, such as regulatory decisions, political instability, and global economic developments, wield considerable influence over cryptocurrency markets. For instance, regulatory crackdowns in major economies can trigger market sell-offs and increased volatility as investors react to new compliance measures. Similarly, geopolitical tensions or economic crises can lead investors to view digital assets as safe-haven assets, causing prices to surge amidst traditional market turmoil.

By comprehending these fundamental market dynamics, traders and investors can better anticipate and respond to the ever-evolving landscape of the crypto market in the face of geopolitical uncertainties.

Key Geopolitical Events and Crypto Reactions

Historical Market Reactions

Reflecting on past instances, geopolitical events like regulatory crackdowns or elections have triggered substantial volatility in the crypto market. For example, the introduction of stringent regulations by governments can lead to market downturns as investors react to the perceived threats. Understanding historical patterns can provide valuable insights for predicting future market behavior amid geopolitical shifts.

Case Studies: Significant Impact Events

Examining specific events such as the US-China trade tensions or Brexit allows us to observe direct correlations with crypto market reactions. During these periods, cryptocurrencies experienced notable price fluctuations in response to geopolitical developments. Analyzing these case studies can offer a deeper understanding of how external factors influence crypto market dynamics and investor sentiment.

Analyzing Current Trends in Crypto Reactions

As I delve into the current trends shaping crypto reactions, two crucial aspects come to light: the impact of social media and news as well as predictive indicators for market responses.

- Impact of Social Media and News

When it comes to the crypto market, social media and news platforms play a pivotal role in shaping investor sentiment and influencing market movements. Platforms like Twitter, Reddit, and mainstream news outlets can quickly spread information, analysis, and rumors that impact cryptocurrency prices. For instance, a tweet from a prominent figure or a breaking news story can lead to significant market volatility and rapid price changes. Monitoring these channels is essential for traders to stay informed and react promptly to market developments. - Predictive Indicators for Crypto Market Reactions

Analyzing predictive indicators is key to understanding how the crypto market might react to upcoming geopolitical events. Factors such as trading volume, price trends, social media discussions, and regulatory announcements can provide valuable insights into potential market movements. By closely monitoring these indicators, traders can make more informed decisions and better anticipate how the market will react to geopolitical developments. Being proactive in assessing these predictive signals can help traders stay ahead of market shifts and capitalize on emerging opportunities.

Strategic Responses for Crypto Investors

Short-Term Trading Strategies

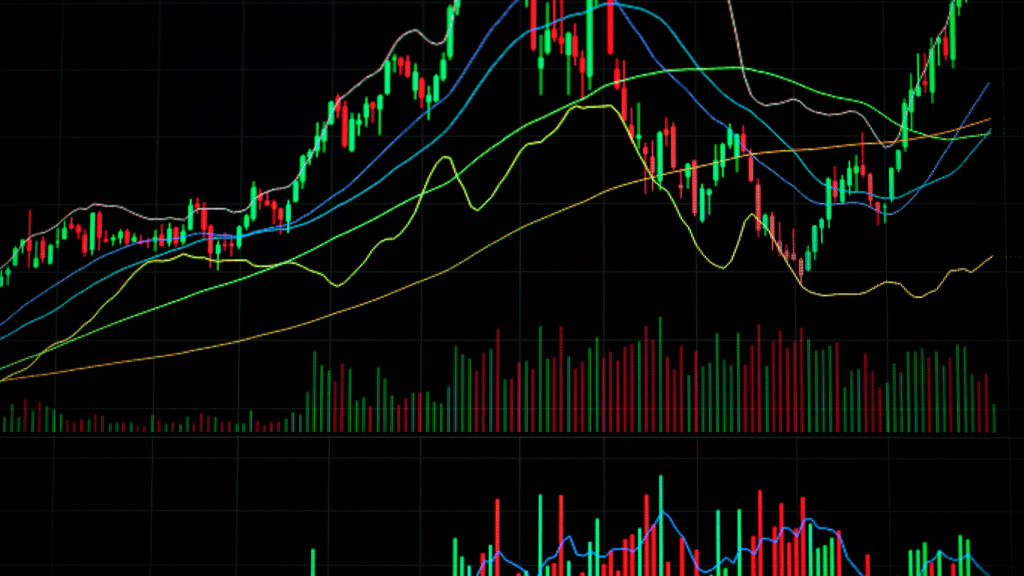

When geopolitical events cause sudden market fluctuations, I adjust my short-term trading strategies to capitalize on volatility. I closely monitor news updates and social media sentiment to gauge market reactions swiftly and make informed decisions. By leveraging technical analysis and tracking trading volumes, I adapt my positions to capitalize on short-term price movements.

Long-Term Investment Adjustments

For long-term investment adjustments in response to geopolitical events, I prioritize portfolio diversification and risk management. I review my investment goals and risk tolerance to ensure my portfolio remains resilient to external shocks. By analyzing historical data and considering the broader economic implications of geopolitical shifts, I strategically rebalance my holdings to align with changing market dynamics.