Mining in 2026: What’s Changed

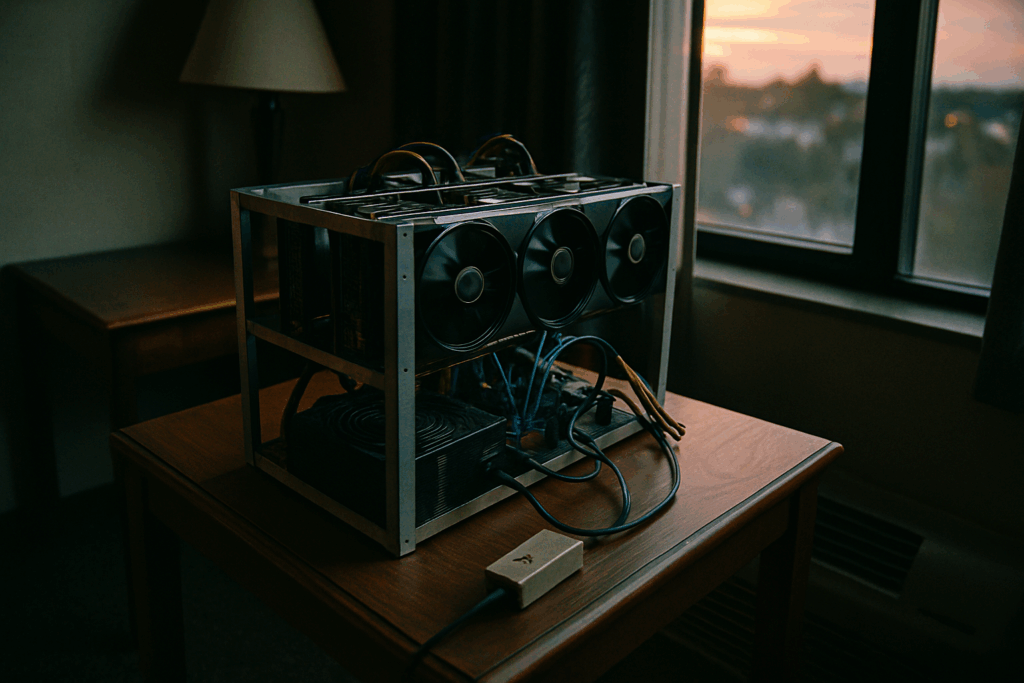

Mining isn’t what it used to be. The old GPU farms that brought in profits from a garage are slowly being outpaced by faster, purpose built ASICs (Application Specific Integrated Circuits). ASICs crush GPUs in raw hash power and energy efficiency but they’re expensive, single purpose, and constantly evolving. In 2026, the gap between casual miners and industrial setups is wide, and widening.

That gap is also fueled by rising network difficulty. As more miners come online and competition spikes, the math problems (aka mining difficulty) get tougher. Your hardware works harder, longer for fewer rewards. One month your operation’s running hot and profitable. The next? Margins vanish. That’s the reality of fluctuating profitability: it’s tied to both market prices and network dynamics you can’t control.

Then there’s the two headed beast every miner has to watch: regulation and energy costs. Governments are circling, writing new laws that aim to curb crypto’s environmental footprint. Energy providers are upping rates or restricting access altogether in certain zones. Mining is no longer just a tech game; it’s a balancing act across legal zones, electric bills, and hardware life cycles.

In short: success in 2026 isn’t about having the most machines. It’s about playing the long game understanding the pressure points and optimizing where it actually counts.

Top Altcoins to Watch

Mining altcoins profitably in 2026 requires more than just good hardware it demands strategic coin selection. Here’s what to look for when identifying winning altcoins.

Core Metrics That Matter

Before dedicating resources to mining a specific coin, consider the following indicators:

Block Rewards: Higher rewards can mean higher profitability, but they should be balanced against network difficulty.

Hashing Demand: Coins with moderate hash rates can be more profitable if they avoid the extreme competition seen in major chains.

Liquidity: A coin that’s hard to sell is a coin that’s hard to profit from. Choose coins listed on multiple exchanges with consistent trading volume.

Network Difficulty: Watch how much power and effort is required to mine a block over time this number can quickly eat into your margins.

Underrated Coins With High Potential

While well known altcoins dominate mining pools, some lesser known projects could surprise in 2026:

Kaspa (KAS): High speed transaction capability and a DAG based structure make it efficient to mine.

Ergo (ERG): Often overlooked but remains GPU friendly with a loyal developer community.

Nexa (NEXA): Designed for scalability with low entry costs, gaining traction among solo miners.

These aren’t guaranteed winners, but their lower network traffic and favorable mining specs make them worth watching.

How to Spot Early Stage Winners

The earlier you identify and start mining a promising coin, the better your returns. Here’s how to boost your chances:

Check Github activity: Active development signals commitment and innovation.

Scan community forums: Reddit, Discord, and mining specific boards can hint at growing interest.

Analyze tokenomics: Understand supply caps, emission schedules, and incentives for holding or burning.

Monitor news and roadmaps: Coins launching major updates or partnerships may see future demand surge.

Related Reading

Want a deeper dive into specific coins? Explore this guide for up to date mining recommendations and performance data: Altcoins for Mining

How to Begin Mining in 2026

Mining profitability depends on more than just selecting a popular coin. The key is aligning your hardware capabilities, personal goals, and risk tolerance with the right setup. Here’s how to get started the smart way.

Match Your Hardware to the Right Coin

Not all altcoins are created equal some are optimized for high powered ASICs, while others are GPU friendly or even CPU optimal. Matching your gear to the right algorithm is step one.

ASIC miners: Best for high efficiency coins like Litecoin or Kadena

GPU miners: Ideal for coins like Ravencoin, Ergo, or Flux

CPU compatible: Less common but coins like Monero still offer room for entry

Use comparison tools to evaluate hash rates, power consumption, and ROI per device.

Solo Mining vs. Pool Mining: Understanding the Trade Offs

Mining isn’t just about the coin it’s also about how you mine it. Solo and pool mining offer different outcomes, especially in 2026’s competitive landscape.

Solo Mining:

High risk, high reward

Full block reward goes to you, but chances of earning are low

Best suited to miners with substantial hash power

Pool Mining:

Lower risk, steady payouts

Earnings shared among all participants

Ideal for beginners or those with mid range equipment

Make sure to factor in pool fees and choose reputable pool operators with active user bases.

Wallets, Tracking Tools & Payouts

Once you’re operational, managing your earnings efficiently is crucial.

Hot wallets for quick access; cold wallets for secure, long term storage

Use mining dashboards (e.g., Hive OS, Awesome Miner) to monitor performance and temperature

Check each pool’s payout threshold and timing policy to avoid surprises

Where Cloud Mining Fits In

If you lack the hardware or want a hands off approach, cloud mining might be appealing. But it requires caution.

Pros:

No noise, heat, or electricity bills

Easy setup, often user friendly dashboards

Cons:

Lower profit margins due to leasing fees

Risk of scams or underperforming contracts

Stick to well reviewed cloud mining platforms and always read the fine print before signing up.

In short, beginning your mining journey in 2026 means more options but also more decisions. The best miners will tailor their strategies, tools, and assets to their realities and goals.

Common Pitfalls to Avoid

Mining in 2026 looks different, but some rookie mistakes haven’t changed. First off, don’t waste your setup on coins with little to no trading volume. If you can’t cash out easily, you’re basically just burning electricity for digital dust. Liquidity matters just as much as profitability projections.

Then there’s the cost people love to ignore: power. Mining rigs aren’t quiet, and they aren’t cheap to run. Between high energy bills and noise complaints, plenty of miners flame out early simply because they didn’t consider location and hardware needs carefully. Know what you’re getting into before you switch that rig on.

And lastly don’t fall for the hype. What’s trending isn’t always viable. A flashy whitepaper or influencer push might spike short term interest, but real fundamentals like community support, development activity, and network stability are what make or break a mining project over time.

Want more specifics? This guide lays it all out: Altcoins for Mining.

Wrapping It Up

Think Beyond Quick Wins

Mining profitability can be tempting in the short term, but sustainable success comes from long term planning. Coins that spike today might drop off tomorrow, so focus on the fundamentals:

Favor altcoins with solid developer support and real world utility

Monitor network activity and hash rate trends over time

Pay attention to regulatory news that could affect specific coins

The most consistent gains often come from coins with longevity, not hype.

Optimization Is Ongoing

To stay profitable in 2026, miners need to treat their setup as a living system. Small tweaks can produce large cost savings and better ROI.

Hardware: Upgrade your rig only after a cost benefit analysis

Electricity costs: Shop providers, optimize power usage, explore sustainable sources

Mining software: Use tools that offer performance benchmarking and auto switching to most profitable coins

Cooling: Invest in airflow, insulation, and quiet operation strategies

Optimization is not a one time setup it’s a cycle.

Discipline Over Luck

Early adopters may have an edge, but those who thrive in mining understand that consistency and discipline win out over trend chasing.

Stick to your strategy: Don’t chase every new coin unless it aligns with your goals

Track your metrics: Know your break even point, payout cycle, and equipment performance

Stay informed: Market conditions shift, and so should your approach

The miners who win in 2026 aren’t lucky they’re prepared, patient, and proactive.